RDTAA 2025 Conference Outcomes: Updates to the R&D Tax Incentive and Compliance Framework

Major compliance framework changes by DISR and the ATO are underway.

Here's what businesses need to know based on RDTAA conference outcome.

25/06/2025

Executive Summary.

New Portal, Faster Reviews, and Stricter Standards: What You Need to Know Now

Full newsletter: June 2025 — RDTAA Conference Outcomes. Read the full newsletter

Major changes to the R&D Tax Incentive commence from mid‑August 2025. A no‑attachments registration portal will require structured, in‑form narratives with clearer sequencing and smarter pre‑fill. At the same time, DISR is tightening review processes and working more closely with the ATO to reduce duplication and bring earlier eligibility calls. The ATO has clarified it can assess activity eligibility even where no formal Board Finding exists. With a renewed focus on ‘At Risk’ expenditure, ‘For Whom’ benefit and record‑keeping, businesses should draft portal‑ready narratives and strengthen documentation now. Gambling and tobacco activities are excluded for income years starting 1 July 2025.

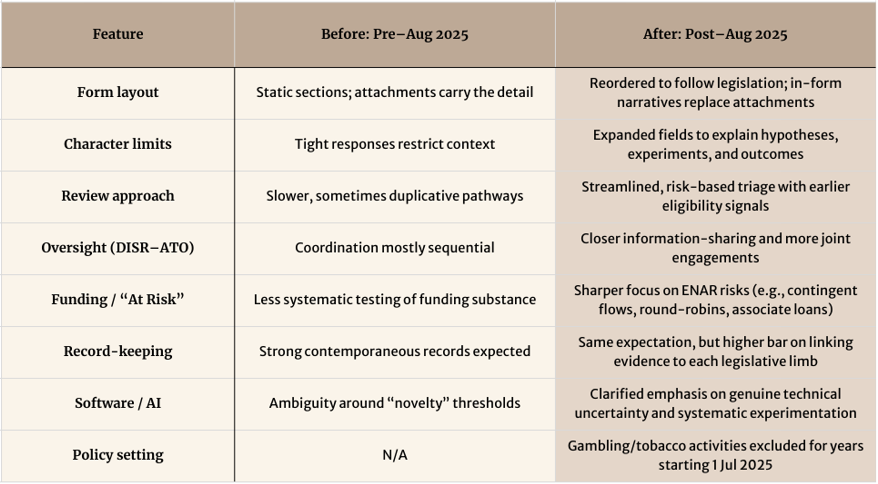

Updated registration form (effective 15 August 2025): Before vs After

Reflects the newsletter guidance on Projects, Core and Supporting R&D sections, expanded character limits, streamlined reviews, and record‑keeping expectations.

In short: the form moves the narrative into structured fields, reviews become quicker but more exacting, and documentation must explicitly tie each activity and dollar to the legislative tests.

Before August 2025, R&DTI registration leaned on attachments and static sections, which often hid the logic of a project behind uploaded files. From mid-August, the story moves into the form itself: applicants explain hypotheses, experiments, and outcomes in structured fields that mirror the legislation. Reviews should feel faster and clearer, but they’ll be more exacting—DISR and the ATO will compare notes earlier and probe riskier claims sooner.

Funding arrangements come under a brighter light: where repayments are contingent or cash appears to “round-robin,” expenditure may be treated as not at risk. Record-keeping has always mattered; now it must explicitly tie each dollar and activity to the legislative limbs. For software and AI, simply wiring APIs together isn’t enough—the bar is genuine technical uncertainty and systematic testing. And with gambling and tobacco activities excluded for income years commencing 1 July 2025, applicants should screen projects and adjust their scopes now.

What’s changing

-

Registration experience

The new portal removes attachments and replaces them with richer answers in structured fields. Prepare for clearer sequencing of Project → Core → Supporting activities and smarter pre-fill. Narratives must be complete, concise, and evidence-referenced within the form. -

Reviews and engagement

Regulators emphasised earlier triage and targeted, joint engagements. Advanced Findings (typically three years; overseas findings may extend for the life of the activity) remain valuable but do not determine expenditure eligibility. -

Funding, “At Risk,” and nexus

Expect detailed testing of who truly benefits (For Whom) and the direct link (nexus) between each dollar and the relevant R&D activity. Arrangements that make expenditure not at risk (ENAR)—e.g., associate loans contingent on the incentive, milestone/round-robin flows, refundable deposits, or third-party pass-through funding—are in focus. -

Record-keeping and substantiation

“Minimum RDTI records” include: why outcomes couldn’t be known in advance, how work differs from existing knowledge, a formal hypothesis, experiment design and data, and objective conclusions (including negative results). R&D record-keeping differs from general tax records—less prescriptive, higher onus to evidence each legislative limb. -

Software & AI

Eligibility turns on technical novelty/uncertainty and systematic experimentation. New algorithms/models and measurable performance deltas are in-scope; evaluations, prompt tinkering, or pure integration generally are not.

What’s changing

- Faster admin, higher bar: A streamlined portal should shorten lodgement and review timelines—but raises expectations for clear, self-contained narratives.

- Substance over form: The ATO will look through “paid” flows that appear contrived. If using related-party funding, mirror genuine third-party loan terms (commercial rates, defined repayment, appropriate security).

- Documentation is decisive: If any legislative limb lacks evidence, the whole claim is at risk.

Do this now

- Draft portal-ready narratives: For every project/activity, write concise, character-fit explanations covering problem/unknown → hypothesis → experiment design → results → conclusions.

- Map dollars to activities: Tag costs to core/supporting activities and maintain explicit nexus notes.

- Evidence “At Risk”: Document funding sources and terms; avoid contingent/round-robin flows; minute commercial decision-making.

- Lift record-keeping: Institute contemporaneous logs, dated hypotheses, test plans, raw data captures, and review minutes.

- Software/AI specifics: Keep design docs, versioned model/algorithm change logs, ablation tests, and objective metrics.

- Use Findings smartly: Consider Advanced/Overseas Findings where appropriate, but continue to evidence expenditure eligibility.

- Ready your team: Prep SMEs for targeted, face-to-face Q&A during reviews.

Key dates

- 1 July 2025 — Gambling and tobacco exclusions apply for income years starting on/after this date.

- Mid-August 2025 — New R&DTI registration portal goes live (structured fields; no attachments).

Who should act now

CFOs, CTOs, R&D leaders, Grants/Tax managers, founders of software/AI-heavy firms, and groups with associate funding structures.

How GWN can help

Readiness reviews: Gap-analysis of narratives, records, and cost mapping against the new portal.

Technical write-ups: Translate complex R&D into portal-fit, plain-English narratives.

Governance & controls: Templates for experiment logs, data capture, decision trails.

Funding structure review: Quick health-check of At Risk/For Whom/nexus exposures, ENAR risks, and intercompany loans.

Author’s Note

The Department of Industry, Science and Resources’ evolving compliance posture, it is more important than ever for businesses to ensure that their R&D activities are supported by contemporaneous, time-stamped records. Both the ATO and DISR are increasingly applying a black-and-white approach when assessing eligibility, focusing not only on whether an activity fits the statutory definition of R&D, but whether there is objective, dated evidence to prove it occurred during the relevant income year. General descriptions, undocumented recollections, or retrofitted justifications are no longer sufficient. Claimants must be able to demonstrate, with specificity, that each step of their experimental process, hypothesis formulation, testing, observation, and evaluation, was planned and executed as a systematic progression of work.

At GWN Consulting, we understand how complex and technical the R&D compliance landscape has become. Our team is here to help you implement best-practice record-keeping systems, review your current documentation protocols, and ensure your claims are robust, defensible, and aligned with the latest regulatory expectations. Don’t leave your eligibility to chance, contact the team at GWN Consulting today to discuss how we can support your R&D governance and documentation strategy.