Important Updates on the R&D Tax Incentive and Regulatory Environment

Major compliance framework changes by DISR and the ATO are now in effect.

Here's what businesses need to know.

25/07/2025

Executive Summary.

New Form, Faster Reviews, and Stricter Standards: What You Need to Know Now

Major changes to the R&D Tax Incentive are coming into effect from August 2025. A new registration form will streamline how applicants describe their activities, with clearer sequencing, more space to explain, and smarter prefill options. At the same time, DISR is overhauling its processes to reduce duplication and fast-track eligibility decisions. The ATO has also confirmed it can assess activity eligibility where no formal Finding exists. With new exclusions for gambling and tobacco activities from 1 July 2025, and a renewed focus on recordkeeping, businesses should act now to review draft applications and strengthen documentation practices.

Updated registration form coming

On 15 August 2025, an updated version of the R&D Tax Incentive (R&DTI) registration application form will be available through the R&DTI customer portal.

The updated form will contain changes to three sections:

Projects

Core R&D activities

Supporting R&D activities

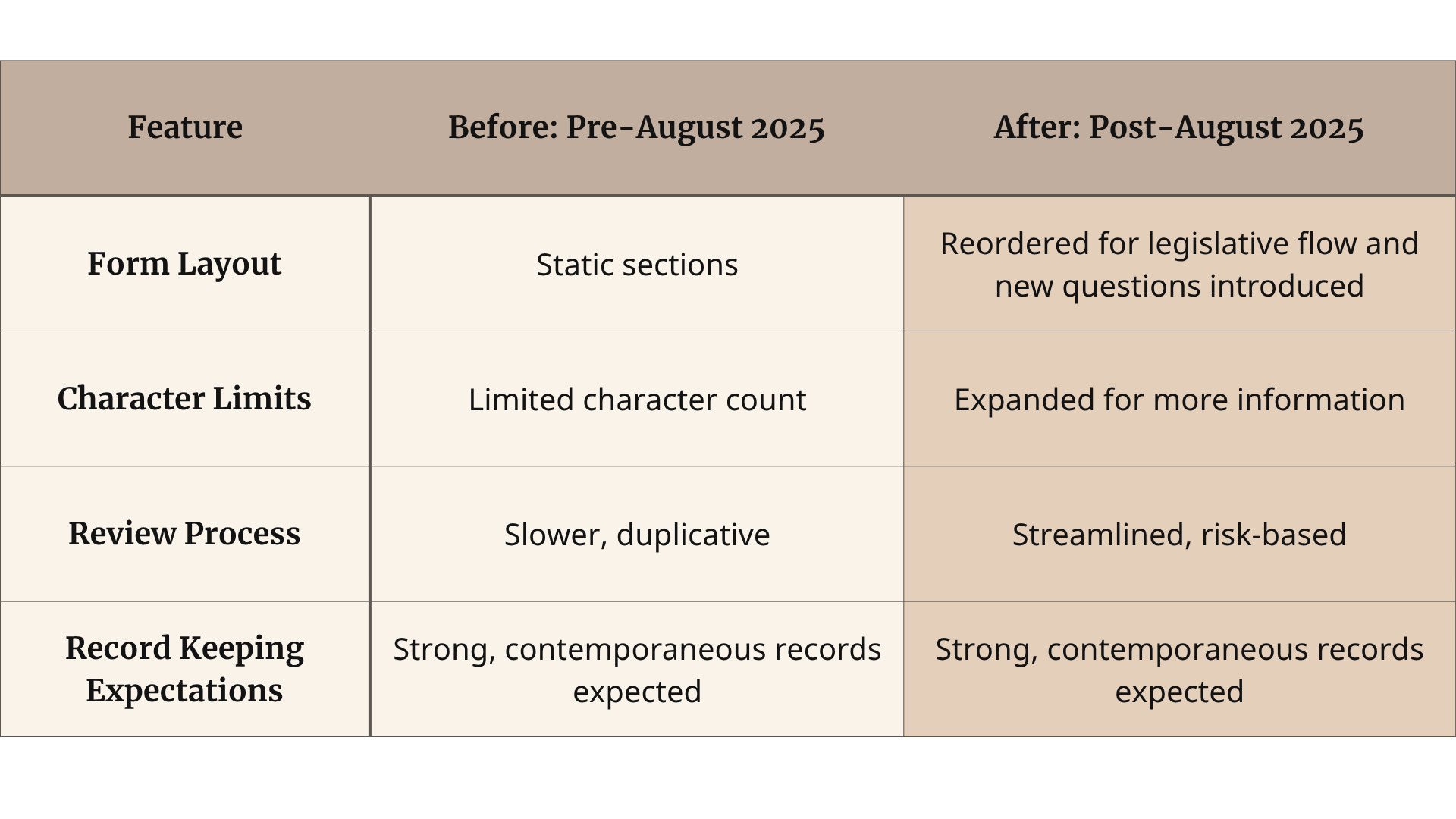

Sections of the form have been reordered to better sequence and align information fields with the legislation. This is to assist users more easily self-assess the eligibility of R&D activities against the legislation. In some cases, new questions have been added or existing questions split into parts.

In response to feedback, character limits have been increased to enable applicants to provide more information about their R&D activities. These changes will help reduce the need for DISR to contact you for more information during the registration process. The number of prefilled questions has also been expanded including pre-populating some project and activity information, and some text fields are changing to drop-down lists/buttons/ tick boxes for easier use.

You can continue to use the existing registration form up until 15 August. Any applications submitted after this date will be required to use the new form. Please note that any draft forms saved within the portal will no longer be available from 15 August. If you have any concerns or questions about the new registration form, email RDTaxIncentive@industry.gov.au.

Read more about registering with the R&DTI.

Business as usual after AAT decision announced

On 16 February 2024 the Administrative Appeals Tribunal released its decision in the matter of GQHC and Commissioner of Taxation.

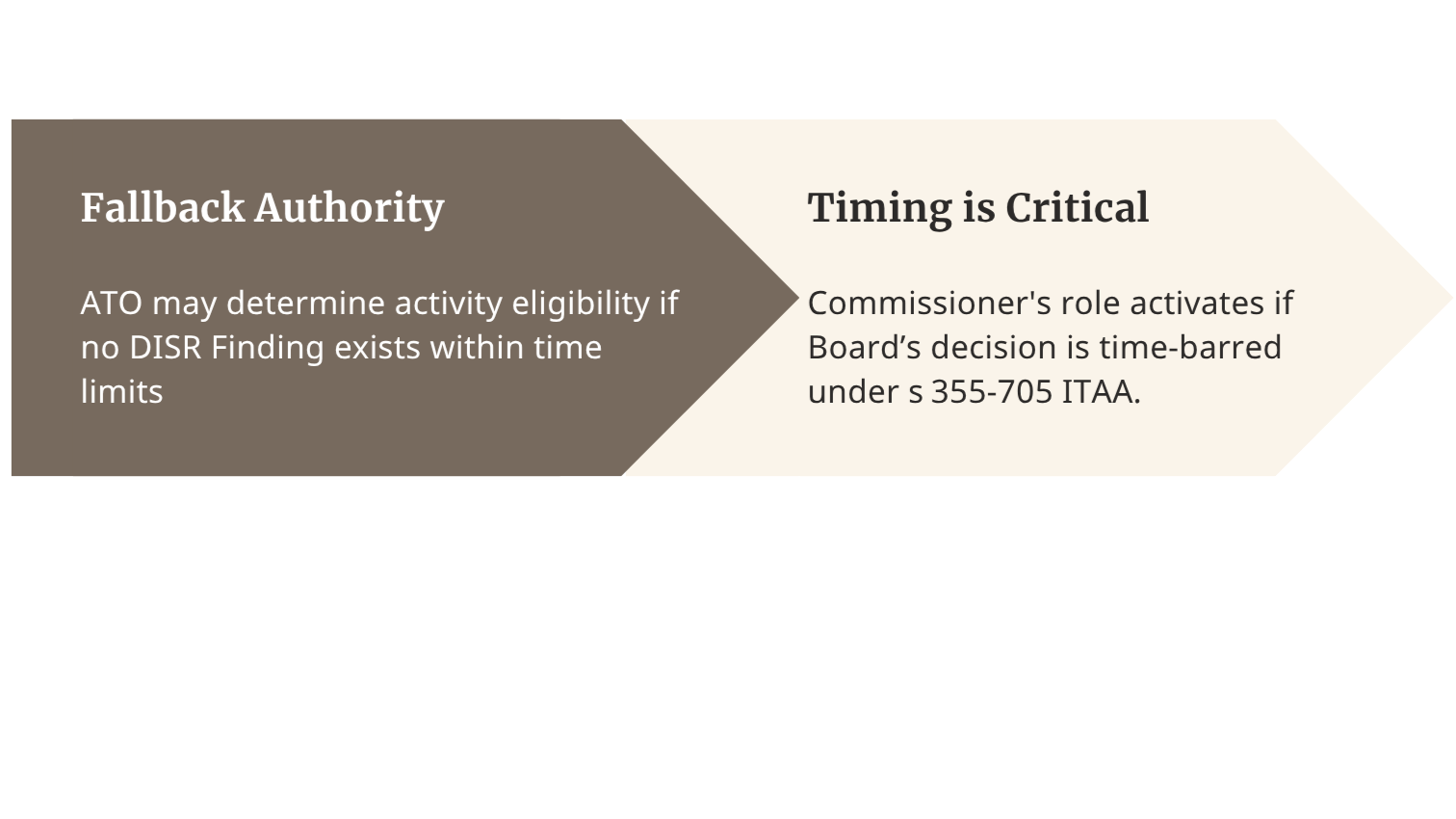

The case included confirmation that, in circumstances where no Finding has been made by Industry, Innovation and Science Australia (the Board) as to whether an R&D entity’s registered activities are core or supporting R&D activities, the Commissioner has the power to assess or make decisions as to whether that entity’s registered activities are eligible 'R&D activities' as defined.

The outcome of this case does not change how the ATO and the department jointly administer the R&DTI.

The ATO follows standard processes and refers matters back to the department to make a Finding. However, in exceptional circumstances, it may be appropriate for the Commissioner to make a decision about the eligibility of an R&D entity’s registered activities.

In this case, there was no existing Finding in place and it was not possible for the department to complete an examination within the time limits detailed in s 355-705 of the Income Tax Assessment Act 1997.

For more information please read the ATO's decision impact statement.

In case you missed it: Changes to eligibility criteria for gambling and tobacco

In December 2024, as part of the Mid-Year Economic and Fiscal Outlook (MYEFO), the government announced proposed changes to the R&DTI program to exclude activities related to gambling and tobacco for income years starting on or after 1 July 2025.

Read the recently released MYEFO.

Streamlining R&DTI business processes

From 1 July 2025, the Department of Industry, Science and Resources (DISR) will be streamlining some of our processes to remove duplication and unnecessary steps that can cause confusion and contribute to delays in finalising program decisions with you.

Recent feedback from you as well as decisions from the Administrative Review Tribunal have highlighted that some of our processes can be confusing. Much of this feedback has centered around the timeframes and processes for obtaining certainty about eligibility.

DISR has listened to that feedback and from 1 July DISR will be progressively implementing streamlined processes designed to improve your interactions with us. These include:

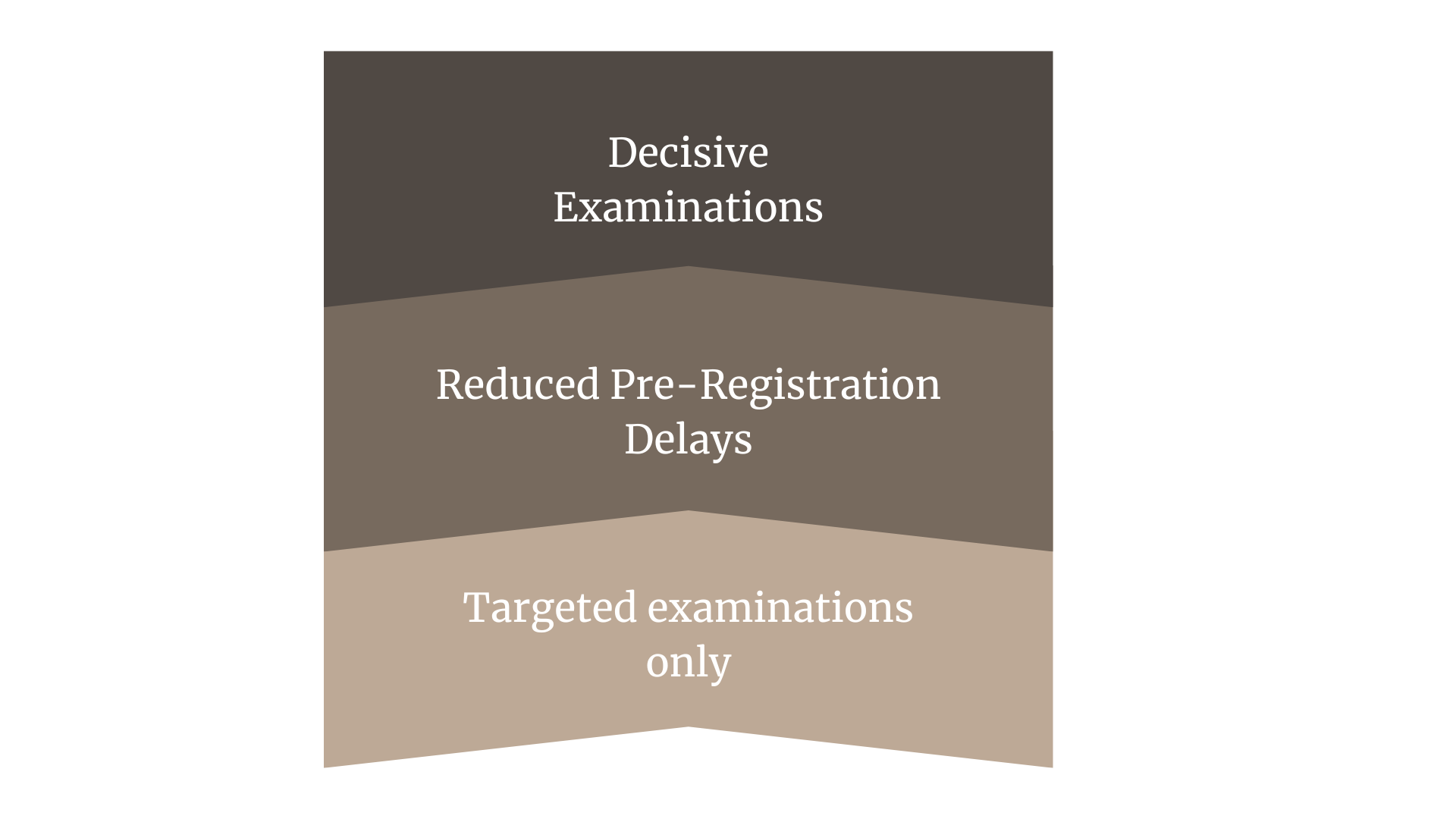

a more efficient approach to conducting examinations which will:

reduce duplicative requests for information.

deliver decisions around eligibility much sooner.

being more systematic in limiting the use of examinations to circumstances when eligibility risks appear highest.

reducing instances of applications being held ‘in review’ prior to registration, helping to reduce the time it takes to register your application and aligning more closely with our service level agreements.

Information about what to expect when you interact with DISR can be found in the R&DTI program charter.

Get record keeping right in 2025–26

Given the beginning of a new financial year, now is a great time to make sure you have good record keeping systems in place.

Under the R&DTI, good record keeping means retaining information that shows the eligibility of your R&D activities and expenditure from the time you intended to start your research to the time you make your tax claim. DISR expect you to keep records that show you meet the legislative requirements to register eligible R&D activities, and how those activities link to your claimed expenditure.

Records are more than accounting documents needed at tax time. Getting your record keeping right will:

• make it easier for you to self-assess your eligibility and ensure you claim your R&D tax offset in full

• streamline your R&DTI application process, as well as any examination of your claims that may happen later down the track

• minimise the risk of your claim being rejected.

It is your responsibility to ensure you are keeping good records.

Unsure of the types of records you need to keep? Please contact GWN Consulting.

Record-Keeping Lessons from the Michael Case

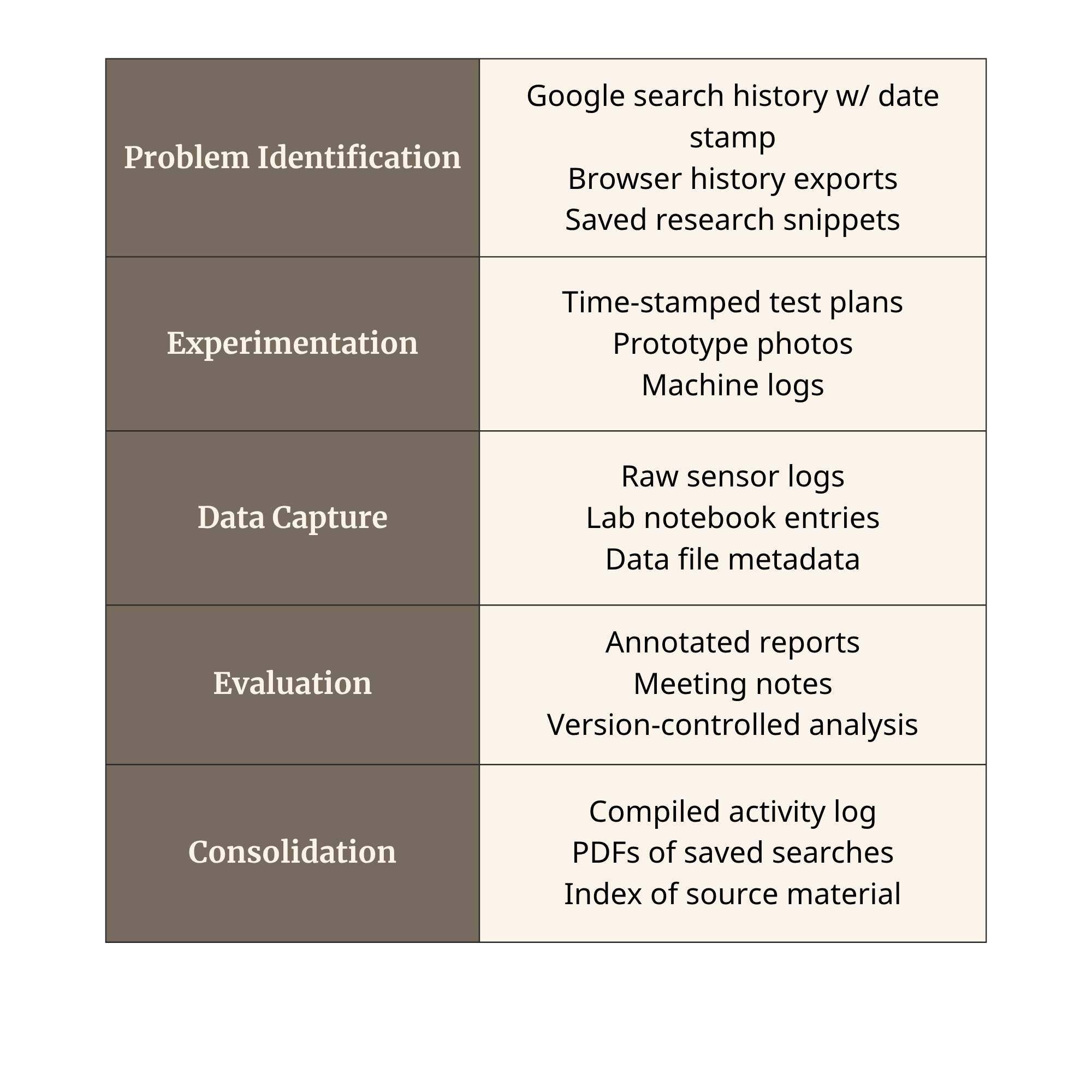

In the recent Body by Michael case (Australia, 2025), the tribunal underscored that robust record-keeping is critical for R&D Tax Incentive claims. The taxpayer’s claim was denied largely due to inadequate documentation of their R&D activities: no hypothesis had been documented at the outset (it was only formulated later), the supposed experiment and knowledge gap were poorly defined, and there was “little to no analysis” showing how results were evaluated or led to logical conclusions.

Even though hundreds of tests were conducted, the work lacked a systematic progression from hypothesis through experiment, observation and evaluation to conclusion. Importantly, the tribunal noted that while the law doesn’t explicitly mandate specific records, “documentary evidence is an expected feature” of genuine R&D, documentation is necessary to record the activity undertaken, its purpose, progress and results, and without it “it is near impossible” to establish that the work was truly experimental and aimed at generating new knowledge.

Tribunal emphasised that records must do more than describe what occurred; they must prove that the activities occurred at a point in time, not merely be constructed or asserted after the fact. In this case, the applicant failed to produce real-time documentation such as dated test records, iterative design logs, or analysis reports created during the conduct of experiments. The Tribunal concluded that such deficiencies rendered it “impossible to conclude” that the activities took place as claimed. The decision highlights that retrospective narrative accounts or recollections are insufficient. Rather, successful claimants must substantiate their R&D activities through contemporaneous, time-stamped documentation that evidences the systematic progression of work.

Evidencing R&D Activities at a Point in Time

Dated experimental plans or research briefs

→ Confirms the hypothesis and proposed methodology were formulated before testing began.

Time-stamped lab notebooks or digital logs

→ Records the day-by-day progression of activities, test attempts, observations, and adjustments.

Dated photographs or videos of experiments, prototypes, or equipment configurations

→ Visual evidence anchoring the work to a specific moment.

Automated data logs from equipment or software systems (with time metadata)

→ Captures test runs, environmental readings, or sensor outputs at precise times.

Emails or internal memos documenting R&D meetings, decisions, or test outcomes

→ Provides context and evidence of evaluation or interpretation at key milestones.

Browser history exports showing date and time of technical searches

→ Provides a traceable timeline of investigative activity, especially valuable when linked to a specific hypothesis or technical roadblock.

Author’s Note

The Department of Industry, Science and Resources’ evolving compliance posture, it is more important than ever for businesses to ensure that their R&D activities are supported by contemporaneous, time-stamped records. Both the ATO and DISR are increasingly applying a black-and-white approach when assessing eligibility, focusing not only on whether an activity fits the statutory definition of R&D, but whether there is objective, dated evidence to prove it occurred during the relevant income year. General descriptions, undocumented recollections, or retrofitted justifications are no longer sufficient. Claimants must be able to demonstrate, with specificity, that each step of their experimental process, hypothesis formulation, testing, observation, and evaluation, was planned and executed as a systematic progression of work.

At GWN Consulting, we understand how complex and technical the R&D compliance landscape has become. Our team is here to help you implement best-practice record-keeping systems, review your current documentation protocols, and ensure your claims are robust, defensible, and aligned with the latest regulatory expectations. Don’t leave your eligibility to chance, contact the team at GWN Consulting today to discuss how we can support your R&D governance and documentation strategy.

Authored by:

Gary Neugebauer

Director

Gary@GWNConsulting.com.au

Lydia Bradbury

Manager

Lydia@GWNConsulting.com.au